A wealth of natural resources is an advantage for Malaysia’s chemicals industry. Since it became independent in the mid-20th century, the country has evolved from a commodities-based economy into a technology and engineering hub.

▲Figure 1. Malaysia is comprised of Peninsular Malaysia and East Malaysia, which are separated by the South China Sea. The coastal sedimentary basins and fertile rainforests provide Malaysia with a wealth of natural resources.

Situated in Southeast Asia, Malaysia is separated by the South China Sea into two similarly sized regions — Peninsular Malaysia, which borders Thailand to the north, and East Malaysia, located on the island of Borneo (Figure 1). It boasts abundant natural resources, as well as incredible biodiversity in the tropical rainforests that cover much of the country.

The Federation of Malaya (present-day Peninsular Malaysia) achieved its independence from the British in 1957. In 1963, Peninsular Malaysia united with North Borneo (i.e., Sabah), Sarawak, and Singapore to form Malaysia. (Singapore was expelled from the union in 1965.)

The Malaysian economy is the third-largest in Southeast Asia (behind Indonesia and Thailand) and 35th in the world. The chemicals industry is a major contributor to the Malaysian economy, with petrochemicals and oleochemicals the primary products of this sector. The country’s exports and imports are dominated by fuels (22% of exports and 16% of imports), chemicals (5% and 7%), plastics and rubber (7% and 5%), and vegetable byproducts, primarily palm oil (8% and 3%) (1).

This article discusses the origins and evolution of the chemicals industry in Malaysia. Current statistics on the country’s petrochemical, oleochemical, and chemical production paint a picture of the state of the chemicals industry today. Finally, the article outlines the challenges and opportunities that Malaysia is expected to encounter as it looks to the future.

Economic background

During the British colonial rule in the early 20th century, tin ore mining and rubber production formed the backbone of the Malayan economy.

Industrial-scale tin ore mining began a century earlier, when an influx of immigrants from China in the 1820s provided a source of cheap labor. By 1895, Malaysia was the world’s dominant tin producer. The industry experienced a downturn during the Japanese occupation from 1941 to 1944, during which the Japanese dismantled one of the primary railroads used for tin shipments. Tin ore mining rebounded, and by the late 1970s Malaysia was responsible for 30% of global tin output. However, a dramatic decline in tin prices in the mid-1980s, as well as depleted deposits and escalating operating costs, curtailed industry output to only 10% of 1970 levels by the mid-1990s (2).

Natural rubber production also began in the 19th century. In 1876, the British introduced rubber trees from the Amazon rainforest to Southeast Asia, and by the end of the century had established commercial-scale rubber plantations (3). The industry flourished until the invasion of Malaysia by the Japanese during World War II. The Japanese occupation afforded the Axis powers control of more than 95% of world rubber supplies, which forced the Allies to find an alternative to natural rubber and spurred the development of synthetic rubber (4). Although the introduction of synthetic rubber reduced the market for natural rubber, by 2001, natural rubber still accounted for 40% of the total global rubber consumption (4). Malaysia currently produces 20% of the world’s natural rubber, but that is expected to decline as prices continue to fall and land-use decisions give priority to oil palm plantations (3).

The decline in Malaysia’s original economic powerhouses — tin ore and natural rubber — is a direct result of actions taken by the government. After independence in 1957, the government rolled out a series of industrial strategies and policies to cultivate manufacturing industries and attract foreign investment. These efforts paid off, and Malaysia enjoyed rapid economic growth in the first half of the 1990s. This development spurred the emergence of the chemicals industry, and many major chemical plants were commissioned during that time.

What was once an agriculture- and commodity-based economy is now led by knowledge-based industries, including computer and electronic products (which are outside the scope of this article), petrochemicals, and oleochemicals.

Oil and gas and the petrochemicals industry

Oil was discovered in what is today East Malaysia at the end of the 19th century. The Shell Transport and Trading Co. (later known as Sarawak Shell) began exploitation of the oil reserves in 1910 and constructed the first crude oil refinery in Miri in 1914 (5). After a major discovery of oil reserves in Peninsular Malaysia in 1978, the industry became a major contributor to the Malaysian economy (6).

The Malaysian oil and gas industry produces mainly natural gas, petroleum products, and petrochemical products. The country ranks 34th in the world for its proven oil reserves and 21st for its gas reserves (6). It is the world’s second-largest exporter of liquefied natural gas (LNG), and boasts one of the world’s largest LNG production facilities at a single location (in Bintulu), with a production capacity of 23.3 million m.t. per year (7). Oil and gas drilling operations are located in the resource-rich Malay Basin, Penyu Basin, Sarawak Basin, and Sabah Basin.

One of the most important milestones for the Malaysian oil and gas industry was the creation of Petroliam Nasional Berhad (PETRONAS) — a government-owned energy company established under the Petroleum Development Act (PDA) of 1974. The PDA affords PETRONAS ownership of, as well as the right to explore and exploit, all Malaysian oil and gas resources. Outside contractors operate under production-sharing contracts (PSCs), which specify how the resources and profits are split between the government and the contractor. To date, more than 150 PSCs (of which, over 100 are currently active) have been awarded to approximately 30 contractors (8).

Initiated by PETRONAS in 1984, the Peninsular Gas Utilization (PGU) project is the longest gas pipeline in Malaysia. The PGU project was completed in 1993, enabling the transport of approximately 2 billion standard cubic feet (BSCF) of processed natural gas from six gas processing plants (GPPs) in Kerteh to various power, industrial, and commercial facilities (9).

The petrochemicals industry in Malaysia began to grow rapidly in the 1990s. The catalysts for the boom included feedstock availability (Table 1), well-developed infrastructure (including the PGU project), and a strong base of supporting services. Many large petrochemical companies, including Kaneka, Polyplastic, BP, Shell, and BASF, established production facilities in Malaysia during this period. The three major petrochemical hubs are located in Kerteh, Gebeng, and the Pasir Gudang/Tanjung Langsat area (7). Petrochemical plants are also located in Labuan (producing methanol), Gurun (urea), and Bintulu (ammonia and urea).

| Table 1. Major petrochemical feedstock producers in Malaysia. Source: Adapted from (7). | ||

| Petrochemical Feedstock | Capacity | Producers |

| Naphtha | 611,000 bbl/day | Petronas Penapisan (Terengganu) Petronas Penapisan (Melaka) Malaysia Refinery Co. Shell Refinery Co. Petron Malaysia Refining & Marketing Kemaman Bitumen Co. |

| Methane, Ethane, Propane, Butane Condensate, Liquefied Petroleum Gas (LPG) | 42.16 million m.t./yr | Petronas Gas Malaysia LNG MLNG Dua MLNG Tiga |

| Ethylene | 1.22 million m.t./yr | Lotte Chemical Titan Holding Petronas Chemical Ethylene Petronas Chemical Olefins |

| Propylene | 955,000 m.t./yr | Lotte Chemical Titan Holding Petronas Chemical MTBE Petronas Chemical Olefins |

| Benzene, Toluene, Xylene (BTX) | 888,000 m.t./yr | Lotte Chemical Titan Holding Petronas Chemical Aromatics |

Announced in 2011, the Pengerang Integrated Petroleum Complex (PIPC) is a 20,000-acre development that is currently being constructed in Pengerang at the southern tip of Peninsular Malaysia. It will include oil refineries, naphtha crackers, and petrochemical plants, as well as an LNG import terminal and a regasification plant, and once completed, it will supplement the downstream oil and gas value chain. The site will house the Pengerang Independent Deepwater Petroleum Terminal (PIDPT), which will have a total storage capacity of 5 million m3, and the Refinery and Petrochemical Integrated Development (RAPID), which will have a refining capacity of 300,000 bbl/day (10).

The growth of the oil and gas industry in the second half of the 20th century spawned supporting industries. After two decades of development, Malaysia is now recognized as a regional center for design and engineering services for the oil and gas industry, with an estimated 3,500-plus oil- and gas-related businesses (11). These companies include national and international machinery and equipment manufacturers, as well as engineering, drilling, fabrication, offshore installation, and operations and maintenance service providers (11).

Although other countries in the region also provide relatively low-cost services, many international clients look to Malaysian engineering companies because of their reputation for quality work at an economical cost. Other attractive factors include good infrastructure, political stability, and ready availability of oil and gas resources.

The Malaysian government aims to position the country as the most important oil and gas hub in the Asia Pacific region within the decade (11). The annual growth of this sector is targeted at 5% for this decade, which translates to an increase of approximately US$35 billion in gross national income (GNI). It is estimated that this growth will create an additional 52,300 jobs, of which 40% will be highly skilled positions such as engineers and geologists (12). The recent downturn in the price of oil may present an obstacle to these growth goals.

[Note: Monetary values were converted to U.S. dollars based on the conversion rate of one Malaysian ringgit (RM) = ~$0.23.}

Palm oil and the oleochemicals industry

▲Figure 2. The Malaysian government has committed to preserving half of the country’s naturally forested land to help limit the environmental impact of oil palm plantations. With limited land availability, palm oil producers will look to improve productivity rather than expand cultivation efforts.

The oil palm tree was introduced to the region by the British government around 1870, with the intention of using it as an ornamental planting. Small plantations began to pop up in the beginning of the 20th century, and in 1917 the first commercial plantation was established. In an effort to diversify the economy and move away from reliance on tin and rubber, the government promoted and assisted the palm oil industry after independence (13). Oil palm is now the biggest plantation crop in the country (Figure 2).

As of 2014, plantations cover 5.3 million hectares, which is split roughly equally between Peninsular and East Malaysia. The plantations produced 19.67 million tons of crude palm oil (CPO) in 2014. Most of the production is exported, with the largest importers being China, European Union, Pakistan, the U.S., and India (14).

CPO refineries were constructed in the 1970s in response to the government’s call for increased industrialization (11). The establishment of palm oil refineries helped the Malaysian economy to transition from commodity-based to manufacturing-based. The country began to produce a wide range of palm oil products, ranging from edible oils to various raw materials for oleochemical production, including palm kernel oil, palm stearin, and palm kernel fatty acid distillate.

More than 15 oleochemical plants, owned by global players such as IOI, Emery, and Kuala Lumpur Kepong (KLK), produce raw material for the manufacturing industries, including the food, pharmaceuticals, cosmetics, and detergent sectors. The major oleochemical exports are fatty acids (32% of all exports), methyl ester (20%), fatty alcohol (19%), soap noodles (15%), and glycerine (12%). Malaysia is now one of the top producers of oleochemicals in the world, accounting for 20% of global capacity as of 2013 (15).

The next step for the palm oil industry will be to boost upstream activities (e.g., extraction of palm oil) and expand downstream sectors (e.g., production of high-value oleochemical derivatives, second-generation biofuels for power generation, and food and health products). The contribution of the palm oil sector to GNI is targeted to reach $40.2 billion by 2020, adding 41,600 jobs (16). Growth is limited by available land area, a disadvantage that the competing palm oil market in Indonesia does not share.

Other chemical industries

Oil and gas, petrochemicals, and oleochemicals are the dominant chemical sectors in Malaysia, but other products contribute to the chemical landscape as well, including plastics, industrial gases, specialty chemicals, among others.

Malaysia is one of the largest plastics producers in Asia, with over 1,550 manufacturers employing some 99,100 people (17). The plastics industry is one of Malaysia’s most vibrant growth sectors, due in part to the well-established petrochemicals industry, which provides a steady supply of feedstock. Major Malaysian plastic manufacturers include Malaysia Electro-Chemical Industry Co. (polyvinyl chloride), Petrochemicals Malaysia (polystyrene), Toray Plastics (acrylonitrile butadiene styrene), and Synthomer (nitrile butadiene rubber). The bulk of the plastics produced in the country are in their nonprimary forms (e.g., household goods, acrylics sheets, packaging, etc.). However, the country also exports plastics in their primary forms, including polyethylene, polyvinyl chloride, and polyethylene terephthalate, and produces more than 60% of the polymers used to produce these plastics (17). Malaysia exports primary-form plastics mainly to China, Hong Kong, Singapore, Japan, and Indonesia (17).

As high-tech industries that produce products such as electronics, silicon wafers, and solar cells prosper in Malaysia, so do the industries that serve them, in particular the industrial gases sector. Malaysian Oxygen (MOX), a joint venture of Malaysian Oxygen, Ltd. and Air Liquide, originally dominated the market. However, the partnership broke up in 2007; part of the company was acquired by the Linde Group, and Air Liquide now operates independently. Other important players in the Malaysian industrial gases market include Air Products, Southern Industrial Gas, and Bintulu Industrial Gas.

Like the industrial gases sector, the specialty chemicals industry has grown as a result of the growth in other industries, including oil and gas, electronics, automotive, and pharmaceuticals. The Linde Group, BASF, Evonik, Dow, and DuPont are some of the top specialty chemicals producers in the country. In addition, manufacturers of quicklime and other lime products, such as Schaefer Kalk, have invested in the region to take advantage of quality limestone deposits (18).

Looking forward

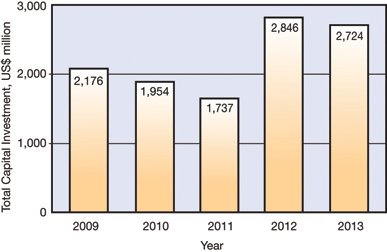

▲Figure 3. Malaysia has increased its capital investment in chemical and petroleum products over the past few years, a trend that is expected to continue. Source: Adapted from (19).

Availability of feedstock and resources, supportive government policies, and a conducive business environment are among the factors fostering the growth of the chemicals industry in Malaysia. Efforts by the government to encourage high-tech industries and manufacturing have been successful in reducing reliance on commodities such as tin and rubber. Capital investment has grown steadily since 2011 (Figure 3) and is expected to continue to grow.

Malaysia is an ASEAN member state and benefits from the ASEAN Free Trade Area (AFTA), which promises to reduce tariffs between ASEAN members to liberalize trade and encourage the region’s competitive advantage as a production hub (20). Malaysia is also a partner in the Trans-Pacific Partnership (TPP), which aims to enhance trade and investment among the 12 TPP participants. The lower trade barriers afforded by this recent agreement should bode well for the chemicals industry. These factors will help Malaysia to continue its charge forward to achieve developed nation status by the year 2020 (13).

Acknowledgments

The author gratefully acknowledges the feedback received from Razmahwata Mohd Razalli, Philip Ng, and Chee Nyok Yoeng, as well as the exposure to the Malaysian chemicals industry provided by Ramlan Aziz.

DOMINIC C. Y. FOO, PhD, P.E., C.Eng., is a professor of process design and integration at the Univ. of Nottingham, Malaysia Campus (Email: dominic.foo@nottingham.edu.my), and the Founding Director of the Centre of Excellence for Green Technologies. He is a Fellow of the Institution of Chemical Engineers (IChemE), as well as the 2012/2013 and 2013/2014 session chairman for the Chemical Engineering Technical Div. of the Institution of Engineers Malaysia (IEM). Foo received the IChemE Innovator of the Year Award (2009), the IEM Young Engineer Award (2010), the Junior Chamber International Outstanding Young Malaysian Award (2012), and the Society of Chemical Engineers Japan Award for Outstanding Asian Researcher and Engineer (2013). He is a licensed professional engineer in Malaysia, and a chartered engineer in the U.K.

Literature Cited

- World Bank, “WITS World Integrated Trade Solution,” http://wits.worldbank.org/country-analysis-visualization.html (accessed Sept. 28, 2015).

- Callan, P., “Development of the Tin Industry in Malaysia,” Expat Go Malaysia, www.expatgomalaysia.com/2012/06/14/development-of-the-tin-industry-in-malaysia (June 14, 2012).

- Shimonski, J., “A Brief History on Rubber Tapping in Malaysia,” Malaysia Flora, www.malaysiaflora.com/index.php?option=com_content&view=article&id=5:a-brief-history-on-rubber-tapping-in-malaysia&catid=13&Itemid=104 (accessed Sept. 28, 2015).

- International Institute of Synthetic Rubber Producers, Inc., “Brief History and Introduction of Rubber,” IISRP, www.iisrp.com/WebPolymers/00Rubber_Intro.pdf (accessed Sept. 28, 2015).

- Royal Dutch Shell, “The History of Shell in Malaysia,” www.shell.com.my/aboutshell/who-we-are/history/malaysia.html (accessed Sept. 28, 2015).

- Zakariah, A., “Overview of Malaysian Industrialization and the Development of the Petrochemical Industry,” Chapter 3 in “Technological Capability Building Through Backward Linkages in the Malaysian Petrochemical Industry,” Univ. of Malaya, Kuala Lumpur, Malaysia, pp. 125–183 (2012).

- Malaysian Investment Development Authority, “Profit from Malaysia’s Petrochemical Industry,” MIDA, www.mida.gov.my/env3/uploads/Publications_pdf/Profit_%20MalaysiaPetrochemical/Petrochemical_July09.pdf (July 2009).

- Zinul, I. F., “Malaysia Has 100 Active Oil Production Sharing Contract, Highest Ever,” The Star (Dec. 12, 2013).

- PETRONAS, “Peninsular Gas Utilization Project,” www.petronas.com.my/our-business/gas-power/gas-processing-transmission/Pages/gas-processing-transmission/peninsular-gas-utilisation.aspx (accessed Sept. 28, 2015).

- Malaysia Petroleum Resources Corp., “Pengerang Integrated Petroleum Complex (PIPC),” MPRC, www.mprc.gov.my/our-businesses/pengerang-integrated-petroleum-complex-pipc (accessed Feb. 2015).

- Malaysian Investment Development Authority, “Oil and Gas,” MIDA, www.mida.gov.my/home/oil-and-gas/posts (accessed Feb. 2015).

- Performance Management Delivery Unit, “ETP Annual Report 2011: Oil, Gas, and Energy,” PEMANDU, http://etp.pemandu.gov.my/annualreport2011/upload/ENG_NKEA_Oil_Gas_Energy.pdf (2012).

- Mahat, S. B. A., “Case Study: The Malaysian Palm Oil Industry,” Chapter 2 in “The Palm Oil Industry From The Perspective of Sustainable Development,” Ritsumeikan Asia Pacific Univ., Beppu, Japan, pp. 12–33 (Sept. 2012).

- The Malaysian Palm Oil Board, “Statistics,” The Malaysian Palm Oil Board, Economic and industry Development Division, http://bepi.mpob.gov.my/ (accessed Oct. 5, 2015).

- Malaysian Investment Development Authority, “Malaysia Chemicals Report 2013 Released,” MIDA, www.mida.gov.my/home/2050/news/malaysia-chemicals-report-2013-released- (Dec. 26, 2013).

- Performance Management Delivery Unit, “ETP Annual Report 2011: Palm Oil and Rubber,” PEMANDU, http://etp.pemandu.gov.my/annualreport2011/upload/ENG_NKEA_Palm_Oil_Rubber.pdf (2012).

- Malaysian-German Chamber of Commerce and Industry, “Market Watch 2012: The Malaysian Plastic Industry,” AHK Malaysia, www.malaysia.ahk.de/fileadmin/ahk_malaysia/Market_reports/The_Malaysian_Plastic_Industry.pdf (accessed Sept. 28, 2015).

- Fletcher, B., ed., “Malaysia Chemicals 2014,” Chemagility, www.chemagility.com/doc/Malaysia%20Chemicals%202014%20-%20DIGITAL%20SAMPLER.pdf (accessed Sept. 28, 2015).

- Malaysian Investment Development Authority, “Malaysia Investment Performance,” MIDA, www.mida.gov.my/home/malaysia-investment-performance/posts (2015).

- Association of Southeast Asian Nations, “ASEAN Free Trade Area (AFTA): An Update,” ASEAN, www.asean.org/communities/asean-economic-community/item/asean-free-trade-area-afta-an-update (accessed Feb. 2015).

Copyright Permissions

Would you like to reuse content from CEP Magazine? It’s easy to request permission to reuse content. Simply click here to connect instantly to licensing services, where you can choose from a list of options regarding how you would like to reuse the desired content and complete the transaction.