Sections

- Introducing BioMADE: Preparing the U.S. to lead the 21st century bioeconomy

- BioMADE’s pilot plant network

- Biology vs. chemistry: Differences between the scale-up of fermentation-based processes and chemical processes

- Launching BioMADE’s network in Minnesota, California, and Iowa

- Geno: A successful scale-up by a BioMADE member

- Best practices for scaling up biotechnology innovations

- Prioritizing U.S. biomanufacturing dominance

- Literature Cited

- Bios

For more than 40 years, the U.S. has been a global leader in biotechnology innovation. However, U.S. start-ups and established companies alike currently struggle to scale these innovations from the lab bench to the commercial market.

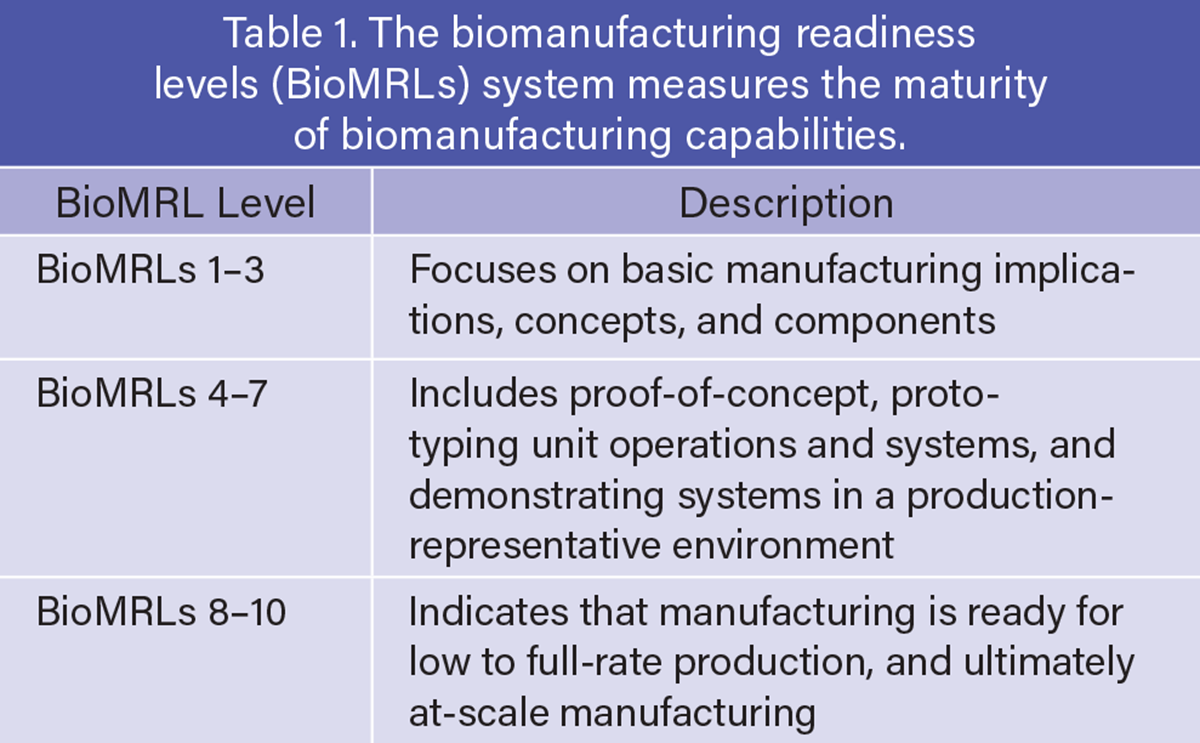

The U.S. bio-industrial manufacturing industry has introduced great solutions to convert renewable feedstocks into fuels, foods, chemicals, and advanced materials. However, despite an increase in research and biotechnology capabilities, many promising products fail to reach the market due to the so-called “valley of death” — the perilous commercialization gap, particularly across biomanufacturing readiness levels (BioMRLs) 4 through 7, where scaling technologies beyond the lab proves technically and financially daunting (Table 1) (1).

Many factors have led to the formation of this valley of death. The biotechnology sector can be viewed by investors as risky due to uncertainty in technology, high production costs, long timeframes to commercial scale, the capital-intensive nature of the industry, and challenges with market uptake, all hindering investment in building piloting infrastructure. Piloting facilities have high operating costs and require a large capital investment, but companies only need access to these facilities for process development and to make small volumes of product. Hence, company leaders find it hard to financially justify building a bespoke piloting facility, leaving the U.S. with a gap in domestic biomanufacturing piloting facilities that are critical for scale-up.

As a result, biomanufacturing start-ups and established companies are often left unsure about how to proceed through the scale-up process domestically, so many opt to scale up their manufacturing processes abroad. Overseas, contract development and manufacturing organizations (CDMOs) have developed biomanufacturing piloting facilities that are often financially supported by government entities. When American companies scale up overseas, there are risks in intellectual property theft and the development of complex international supply chains in a highly regulated industry.

This article summarizes BioMADE’s work to close the gap in the biomanufacturing piloting infrastructure in the U.S., including a scale-up case study from sustainable materials company Geno. It also provides best practices and solutions for bridging the valley of death to commercialize American biotechnology innovations successfully.

Introducing BioMADE: Preparing the U.S. to lead the 21st century bioeconomy

Bio-industrial manufacturing uses microbes to ferment sugars from feedstocks — like corn and sugar beets — creating new or better materials that we use every day, like fibers, fuels, plastics, adhesives, and more. The biomanufacturing industry is part of the rapidly growing biotechnology sector. It is estimated that up to 60% of products in the global consumer supply chain can be made using biotechnology (2), and by 2030, most people on the planet will have consumed, worn, or been treated by a product featuring emerging biotechnology (3).

In 2020, BioMADE was catalyzed by the U.S. Dept. of Defense as a nonprofit, public-private partnership intended to drive the transformative biomanufacturing movement in the U.S. BioMADE operates in three distinct areas: investing in technology and innovation, driving education and workforce development, and building scale-up infrastructure.

BioMADE is a membership organization with a network of nearly 350 members across 40 U.S. states. The organizations — ranging from leading industry companies, start-ups, universities, community colleges, and nonprofit organizations — bring together the best and brightest minds working in biomanufacturing.

BioMADE’s pilot plant network

In addition to funding biomanufacturing innovation research and developing the U.S. biomanufacturing workforce, BioMADE is building a national network of critically needed biomanufacturing scale-up facilities that will transform the future of American manufacturing. This network will allow start-ups and established companies to transition their products from the laboratory to commercial production right here in the U.S. Specifically, these facilities will provide organizations with the necessary equipment and knowledge to test and validate biomanufacturing processes at a larger scale and for longer durations of time. Customers of BioMADE’s pilot plant network will include large and small industrial companies, research institutions, and government entities.

The facilities are funded through federal and non-federal co-investment, and will be specially designed to meet national needs, while also serving the unique needs of the regions where they are based. As the biomanufacturing sector grows, the large-scale commercialization of biobased products will help to reshore manufacturing jobs, creating far-reaching career pathways and supporting U.S. farmers by providing new markets for their feedstocks. These facilities represent a national security priority as well, building out the defense industrial base and providing novel solutions for the Dept. of Defense to ensure that U.S. warfighters remain ahead of the curve.

Currently, many American companies are forced to use contract manufacturing organizations (CMOs) in China, Germany, India, Mexico, and elsewhere to access the infrastructure they need (4). In April 2025, the National Security Commission on Emerging Biotechnology report highlighted the need for federal funding for a network of bio-industrial product scale-up facilities (3).

Biomanufacturing piloting facilities are needed to address two significant steps in the commercialization of a biobased product (Figure 1). First, the production process needs to be run at a larger scale (than lab-scale) to gather process performance data that allows the design and engineering of the full-scale production process. As detailed in the next section, there are significant differences between biological processes compared to chemical processes that drive the need for operating at a pilot scale. Second, the piloting runs are required to produce final product, which is needed for product development activities within the company as well as application testing with their customers.

▲Figure 1. Biomanufacturing piloting facilities, like the California BioMADE facility shown in the middle image, address two important steps in the commercialization process: gathering process performance data and producing on-spec final product. Because these steps are not feasible at the lab scale, piloting represents a crucial part of bridging the bioproduct “valley of death.”

Biology vs. chemistry: Differences between the scale-up of fermentation-based processes and chemical processes

Microbes and chemical catalysts both convert a raw material into a desired product to achieve a specific yield and selectivity. However, there are distinct differences that impact the scale-up of fermentation processes to bear in mind as you scale up.

Microbe performance can change with varying operating environments at larger scales. Microbes are living organisms that react to changing operating conditions such as low oxygen levels. For benchtop experiments, the agitation can be set to create a nearly homogeneous environment. As the fermenter gets larger, it becomes more difficult and expensive to create a nearly homogeneous environment, and gradients in oxygen concentration, pH, temperature, and other operating parameters can arise. Depending upon the robustness of the microbe, these gradients can alter the metabolism of the microbes, thus impacting the yield and selectivity of the process.

Managing microbial contamination requires process development. Ideally, the desired microbe is the only microbe in the fermenter. However, other microbes can contaminate the fermenters despite the development of microbial techniques and sterilization processes. Bench-scale fermentation often meets the ideal situation with no contamination. But as the scale increases, there are more seed train steps, larger surface areas to sterilize, and different sterilization processes that make large-scale fermenters more prone to contamination by undesired microbes. These undesired microbes consume raw materials and produce unwanted byproducts that may have to be removed in the purification process. During the piloting process, the effectiveness of standard sterilization processes will be tested and may need to be optimized over time.

Process development is also required for seed train and fermenter turnaround to meet capacity goals. Most large-scale fermenters are run in a batch mode. The technical details and timing of these large fermenters cycling through inoculating, fermenting, and draining, and then cleaning and sterilizing the fermenter for the next batch, need to be determined during the piloting stage. The seed train process must operate in conjunction with the main fermenter cycle to produce the required high-quality inoculum for the large fermenter needed in the production cycle. The commercial plant will be designed based on the timing of this overall cycle, so developing robust operating processes and designing the commercial plant to execute on those processes allows the plant to meet capacity goals.

Launching BioMADE’s network in Minnesota, California, and Iowa

BioMADE has announced the locations for three facilities in its pilot plant network. First, BioMADE is constructing a demonstration-scale facility in Maple Grove, MN (Figure 2) (5). The fermentation capabilities at this site will include 5,000-L and 25,000-L fermenters, smaller seed train fermenters to create the inoculum for the main fermenters, as well as space and height for additional fermentation capacity in the future. The site will feature extensive upstream and downstream biomanufacturing capabilities, such as dedicated dextrose and aqueous ammonia tanks, media preparation tanks and sterile filters for media, harvest tanks, disk-stack centrifugation, ceramic and polymeric membrane filtration, evaporation, crystallization, filtration, and drying, clean-in-place systems, and high-temperature short-time (HTST) sterilizers.

▲Figure 2. BioMADE is constructing facilities in Minnesota (left) and Iowa (right) that will house several large fermenters for piloting of new bioproducts.

The Minnesota facility will also offer other BioMADE services, such as education and workforce development training. The facility will start operations in 2027.

BioMADE is also fast-tracking a pilot-scale facility in Hayward, CA, through an agreement with member Lygos (6). The site will initially include a 4,000-L fermenter, harvest tanks, centrifuges, membrane filtration, evaporation, and spray drying. Additional fermenters and downstream processing capabilities will be added over time. BioMADE is aiming to open this first facility to customers in 2026.

In August this year, BioMADE announced its third facility in the network: a pilot-scale facility near Ames, IA (Figure 2) (7). Set to open in 2027, the facility will include a 10,000-L fermenter, dry and wet lab space, and downstream processing capabilities centered around the development of agricultural bioproducts, chemicals, food, and more.

All sites in BioMADE’s pilot plant network will be multi-user facilities, accessible to companies whose production levels have outgrown their own lab spaces. Companies will be able to use BioMADE’s facilities to scale-up the manufacture of goods as they consider building their own commercial-scale manufacturing facility or partnering with a CMO for production. Currently, the U.S. has a major gap in domestic pilot- and intermediate-scale bio-industrial manufacturing, leaving American companies to seek relevant facilities overseas to scale up their production to commercial scale.

These historic investments in biomanufacturing infrastructure will position the U.S. as a global leader in biomanufacturing, support national security initiatives, boost economic opportunities, increase markets for farmers, and bring well-paying manufacturing jobs to the U.S.

Geno: A successful scale-up by a BioMADE member

Geno is leading the biomanufacturing of sustainable commodity chemicals at scale. Following the successful scale-up of biobased 1,4-butanediol (BDO), Geno is advancing the commercialization of biobased caprolactam (CPL), the monomer used to produce Nylon-6. Nylon-6 is a high-performance polymer with a multibillion-dollar global market value that is essential in applications ranging from textiles and apparel to packaging and automotive components. To de-risk commercial deployment, Geno is scaling up CPL through multiple production campaigns and has learned valuable lessons along the way. These include the importance of establishing strategic partners, developing rigorous technology transfer planning, and thoroughly vetting CDMOs.

Geno has cultivated strategic collaborations across the Nylon-6 value chain, including with Aquafil as a development partner and with lululemon as a brand partner and downstream customer. These partnerships enabled early alignment on critical technical and commercial parameters, such as defining CPL specifications to meet performance requirements across all major Nylon-6 applications, establishing technoeconomic models and KPIs, determining CPL product volumes necessary for applications testing, and setting up program timelines. These integrated value chain collaborations were instrumental in accelerating overall process scale-up and market entry, culminating in innovations such as lululemon’s launch of the world’s first plant-based Nylon T-shirt on Earth Day 2023.

To facilitate scale-up, Geno prepares months in advance to ensure that production campaigns are set up for success and will enable process validation, data collection for engineering and commercial plant design, and generation of high-quality materials. Preparatory activities include detailed planning and execution of scaled-down experiments to mimic large-scale conditions, microbial strain robustness tests, process development and sensitivity analyses via flowsheet simulations, and structured technology transfer protocols at CDMO facilities.

Another critical component of process scale-up is the selection of skilled CDMOs with well-instrumented fermentation, downstream purification, and analytical capabilities. Geno engaged CDMOs in Europe due to limited domestic facilities equipped for large-scale fermentation (50,000–100,000-L). Furthermore, multiple CDMOs were contracted across sites as no single CDMO possessed the full suite of required capabilities. Key criteria influencing the selection of European CDMOs included technical expertise, facility availability, operating costs, and geographic proximity to preserve material integrity during intermediate product storage and transfer between sites.

In summary, Geno has leveraged its prior successful experience in scaling up biobased BDO to guide its scale-up methodology for biobased CPL by encompassing early-stage value chain integration, rigorous process development, and strategic CDMO engagement. These efforts not only demonstrate the technical feasibility of replacing petrochemical-derived monomers with renewable alternatives, but also highlight the critical role of cross-functional collaboration in accelerating the transition to sustainable materials.

Best practices for scaling up biotechnology innovations

BioMADE’s pilot plant network and Geno’s case study demonstrate that with strategic investment and thorough planning, the U.S. can become an even more nurturing environment for start-ups and established companies alike to domestically scale up their biotechnology products. Read on for experience-based best practices and industry takeaways to learn what to expect as you work with a CDMO to move a product from pilot-scale to full commercialization.

Laying the foundation — planning ahead during the piloting process. It is important to understand that the piloting path goes beyond executing piloting runs. Specifically, any CDMO will have many questions to ask about the current state of knowledge in the piloting process before committing to the scale-up of any technology. Make sure not to underestimate the amount of time and resources it will take to compile all this information and make sure it is accurate.

There are a few key areas that all companies should invest in during the piloting process. First, companies should put together a robust and comprehensive technology transfer package. This detailed plan should contain all the necessary information to transition the specific fermentation technology across different laboratories, including key performance indicators (KPIs), microbiology techniques, and analytical chemistry methods. Second, safety and regulatory reviews must be conducted prior to any laboratory or piloting work. By coordinating these reviews at each site for every processing step in both lab and piloting settings, biomanufacturers can ensure that their processes can be scaled up without delays. Lastly, companies should identify and make use of the process modeling tools, proper piloting equipment, and downstream processing resources required to achieve their specific goals. A thorough process development methodology should include validating process models with data across all experimental scales and identifying specific equipment within a general category to test production at both bench- and piloting-scale.

There are also a few common pitfalls that biotechnology companies often overlook and fall into during piloting efforts to develop their commercial products. Companies that look to make a product for an existing market, often called a “drop-in” product, will need to meet the existing specifications for that product. However, these specifications were likely set for a product’s impurity profile manufactured through the incumbent process, often using petrochemicals. Consequently, the new fermentation route will produce a different set of impurities that may not be completely removed after downstream purification. Biomanufacturers need to partner with their customers to understand the impacts, if any, that these trace amounts of fermentation-derived impurities have on the formulation and final product performance.

Additionally, companies often underestimate costs that can make fermentation-based products more expensive than their initial cost analysis. Specifically, fermentation-based processes sometimes require more capital (in the form of equipment purchases) and more energy if the concentration of the fermented product is low. These energy costs and operating costs per unit of volume can be reduced by using larger commercial assets down the line, but they must be considered and well understood from the beginning. This can be accomplished by performing detailed process modeling and technoeconomic analysis of the process to be validated and updated during piloting.

The piloting process is the foundation of commercialization. By spending time and resources here, start-ups and established companies can go to CDMOs with the confidence and knowledge needed to tackle BioMRLs 4 through 7.

Choosing the right CDMO. The perfect CDMO partner can make all the difference in a successful commercialization process. Performing due diligence up front with multiple CDMOs will help ensure that the chosen partner has the capabilities to perform the work at a price that makes sense.

First, many CDMOs will not have all the required downstream processing equipment on site, thus companies need to understand the extent of potential partners’ capabilities. They should know what the CDMO can and cannot do, as well as what is included in the base price. During piloting, start-ups and established companies will want to collect much more data than they would during normal production runs, so they need to ensure that all measurement systems are set up, including off-gas analysis, multiple dissolved oxygen (DO) probes at different heights, and more. It is also critical to understand the logistics and prices around various trial runs, including raw materials, utilities, labor, waste costs, material storage, and CDMO-to-CDMO shipping fees.

Furthermore, while conducting this due diligence on potential CDMOs, companies should already be proactively considering timelines for getting into the production schedule early. Unless CDMOs have their own product line, their business models can be very cyclical in nature. Consequently, CDMO availability often fluctuates such that a CDMO could potentially put a new request onto the schedule as soon as technology transfer is complete, or the new request could be scheduled out more than a year. This variability is important to factor into the decision-making process. Companies must understand when their processes will be run on the CDMO’s schedule, especially if they are looking to manufacture products for a specific customer or capitalize on a timely market demand opportunity.

By following these tips, companies can make sure that their chosen CDMO is a partner in the truest sense of the word. This relationship can be cultivated over time to support successful commercialization.

Building a relationship: Fostering long-term collaboration with a CDMO. All biotechnology companies should strive to develop a close working relationship with their chosen CDMO, as this partnership will prove critical when crossing the valley of death. Once a CDMO partner is selected with a clear understanding of all costs, the company should quickly complete a detailed technology transfer package. A thorough package will allow the CDMO to work effectively, expediting the process of getting an innovative new process into the production queue, especially when using larger equipment. The more knowledge shared about a process, the faster the CDMO can vet the process and product and start doing their job.

Prior to running any piloting tests, companies should reach a couple of key understandings with their chosen CDMO. First, they should decide on all sample points and data to be collected to support the overall mass balance produced for the runs, as well as any other key information, like block flow diagrams, process control description, raw material specifications, and more.

Companies should proactively work with CDMO personnel to understand and get ahead of potential challenges. These barriers should be categorized to support future design optimization. For example, if a centrifuge is the wrong type but it is the only kind a CDMO can get for a test run, be sure to note to work with the correct centrifuge in the future, possibly using a rental skid, that would be used in a production facility. Then, companies can ensure that they will have the best technology package in place when they are ready to build a facility of their own.

Furthermore, companies should compile a list of all efficiency improvements uncovered during the piloting effort to cultivate an in-depth understanding of how processes can be refined. Often, the CDMO team can be helpful in incorporating industrial knowhow on operations into that list. All this information will be extremely useful when working with engineering, procurement, and construction (EPC) partners on larger-scale commercial facilities. Ultimately, this strategy will lay the groundwork for a more efficient, lower cost, and faster paced commercial production pipeline.

Multiple factors must be considered when identifying and evaluating efficiency improvements, and CDMOs should play a collaborative role as trusted advisors. First, throughout the scale-up process, trials should be run using an experimental grid to map out yields over a range of temperatures, pH levels, and aeration and agitation conditions. Ideally, this experimentation should happen at lab scale in well-designed scaled-down models so that the CDMO can focus on confirmation of performance. Companies should ensure that the CDMO team is a partner in taking notes of physical properties, product and impurity concentrations across separation steps, and unexpected processing events. The CDMO team can also help in determining adverse events that are expected to happen occasionally in a large-scale manufacturing environment, as well as the options for operational responses. In fact, robustness tests for common deviations should be done in the lab prior to scale-up in order to develop responses for such deviations.

There are natural variations and upsets in any process, and biomanufacturers must understand if these events will impact the ability to meet product specifications, particularly in downstream processing unit operations. If this variation causes the product not to meet specifications due to high impurity levels, a contingency step — such as additional process development — should be taken to understand the specific unit operations that remove those impurities, as well as the operating window that allows the specifications to be met. For example, when a batch does not meet specifications, a blending strategy may be needed. By operating the downstream processes to minimize impurities, this high quality product can sometimes be blended with the out-of-spec material to create a final yield that meets specifications. This is dependent on the specific impurities that are out of specification and cannot be done in all cases. The company will need to work with the customer on these strategies.

Lastly, CDMO partners are a great resource to continue relying on as biotechnology start-ups and established companies consider working with an EPC for full commercialization. For example, CDMO partners should play a key role in helping to develop a “cost of goods sold” model, facilitating an accurate overall technoeconomic model. Even if the company has limited experience in this area, it should at least play a role in facilitating a connection with a third-party vendor who can build these technoeconomic models. A strong CDMO partner will go above and beyond to make sure your product is a success through full commercialization.

As companies move forward toward front end loading (FEL) engineering packages, they will likely engage with an EPC firm, preferably one that has demonstrated success with similar projects. Companies and engineering firms should methodically build out the details of the design to get increasingly accurate capital project estimates. During this engineering design process, companies should also review brownfield, greenfield, and even acquisition options. While this transition can seem daunting, companies can even consider extending their relationship with respective CDMOs for smaller volume production and as subject matter experts on operations. For example, if hiring CDMO personnel as a temporary contractor is an option, these trusted advisors can support commissioning, starting up, and optimizing new processes. They will already have the experience and knowledge from previous runs that can help get the process moving faster. By cultivating a strong and productive working relationship with CDMOs, start-ups and established companies can secure a key partner in scaling biotechnology products and set themselves up for long-term success.

Prioritizing U.S. biomanufacturing dominance

Regardless of commercialization strategy, start-ups and well-established companies can all use a hand to help cross the valley of death. BioMADE understands that at this critical juncture in the biomanufacturing industry, the U.S. needs a collaborative ecosystem to get bio-industrial products to market so that companies are not forced to commercialize products abroad. BioMADE’s pilot plant network will achieve those goals. With information sharing, like the best practices included in this article, the American biotechnology community can come together and make sure that our nation remains a world leader in biotechnology innovation and commercial-scale biomanufacturing.

Literature Cited

- Smanski, M. J., et al., “Bioindustrial Manufacturing Readiness Levels (BioMRLs) as a Shared Framework for Measuring and Communicating the Maturity of Bioproduct Manufacturing Processes,” Journal of Industrial Microbiology and Biotechnology, 49 (5) (Sept. 2022).

- Chui, M., et al., “The Bio Revolution: Innovations Transforming Economies, Societies, and Our Lives,” McKinsey Global Institute, https://www.mckinsey.com/industries/life-sciences/our-insights/the-bio-revolution-innovations-transforming-economies-societies-and-our-lives (May 13, 2020).

- National Security Commission on Emerging Biotechnology, “Charting the Future of Biotechnology,” NSCEB, https://www.biotech.senate.gov/wp-content/uploads/2025/04/NSCEB-Full-Report-%E2%80%93-Digital-%E2%80%934.28.pdf (April 2025).

- Hodgson, A., et al., “The U.S. Bioeconomy: Charting a Course for a Resilient and Competitive Future,” Schmidt Futures, https://www.schmidtfutures.org/wp-content/uploads/2022/04/Bioeconomy-Task-Force-Strategy-4.14.22.pdf (Apr. 2022).

- BioMADE, “BioMADE Finalizes $132M National Security Investment in Demonstration-Scale Biomanufacturing Facility in Minnesota,” https://www.biomade.org/news/biomade-announces-mn-demo-scale-facility (Apr. 29, 2025).

- BioMADE, “BioMADE and Lygos to Fast-Track Pilot Biomanufacturing Facility in California,” https://www.biomade.org/news/biomade-and-lygos-to-fast-track-pilot-biomanufacturing-facility-in-california (Apr. 30, 2025).

- BioMADE, “BioMADE Expands Biomanufacturing Pilot Plant Network with New $40M Biomanufacturing Facility in Iowa,” https://www.biomade.org/news/facility-in-iowa (Aug. 15, 2025).

Copyright Permissions

Would you like to reuse content from CEP Magazine? It’s easy to request permission to reuse content. Simply click here to connect instantly to licensing services, where you can choose from a list of options regarding how you would like to reuse the desired content and complete the transaction.